You can't onboard a 1099 contractor like they're a W2 employee. But brokerages try anyway.

Mandatory weekly meetings. Forty-seven different logins. "You must use our CRM" requirements. Then brokers wonder why experienced agents leave for lower-split shops and new agents can't get traction. The tension isn't new, but post-settlement, it's become unsustainable.

The Problem Nobody Wants to Say Out Loud

Real estate agents are independent contractors. Legally, structurally, tax-wise. But operationally, brokerages expect them to function like employees. Follow the systems. Use the tools. Show up to the meetings. Stay compliant with policies that weren't negotiated, just handed down.

Here's the thing: some of that is necessary. Compliance isn't optional. Transaction management needs structure or deals fall apart. But the way most brokerages implement these requirements assumes a level of control they don't actually have, because if an agent doesn't like your systems, they leave. They're contractors. That's the deal.

Why the Old Model Is Dead

Ten years ago, this tension was manageable. The barrier to entry for starting a brokerage was high, and agents tolerated mandatory meetings and clunky systems because the alternative was starting from scratch. That leverage is gone.

Today, an experienced agent can join a low-overhead brokerage charging $500/year, use their own tools, keep 95% of their commission, and operate exactly how they want. If your value proposition is "we give you MLS access and make you sit through Tuesday meetings," you've already lost.

The NAR settlement made this worse. Written buyer agreements mean every agent needs to articulate value in the first conversation. No more shadowing for six months. Agents need to be operational immediately. But most brokerage onboarding wasn't built for that.

The Middle Ground That Actually Works

You can't force compliance through control, but you can build systems so good that agents choose to use them. The brokerages winning right now aren't the ones with the strictest policies. They're the ones with the best infrastructure.

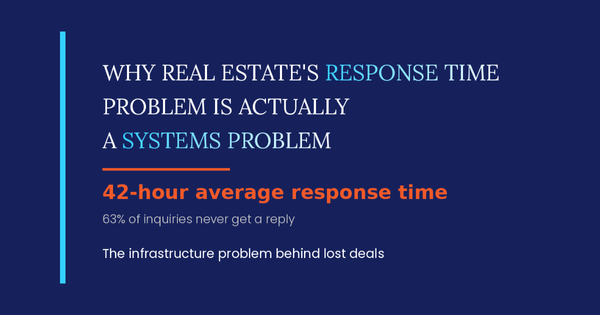

Consider this scenario: The old way meant a new agent asking "How do I order a lockbox?" had to post in Slack, wait six hours for a response, get told to "check the Google Doc," then spend 20 minutes hunting through page 47 of "Operations Manual v3 Final FINAL." The better way means the agent asks the question, gets an instant accurate answer with a direct link, and it takes 30 seconds.

That's not micromanagement. That's infrastructure. When you build infrastructure like that, agents stop leaving. Not because they're required to stay, but because you've removed the friction that made them want to leave.

What Brokers Should Do Instead

Stop treating onboarding like training. Onboarding isn't compliance modules and team introductions. It's infrastructure that works when an agent has a question at 9 PM on Saturday, because real estate doesn't stop at 5 PM.

Document everything, then make it searchable. If the answer to "how do I do this?" lives in someone's head or requires asking in Slack, you don't have a system.

Give agents autonomy, but make your systems better than the alternatives. Don't force agents to use your CRM. Make it so integrated and easy that they choose it. The test: if an agent had a choice between your brokerage system and paying for their own tools, would they choose yours? If not, you don't have a tool problem. You have a value problem.

The Bottom Line

The 1099/W2 tension isn't going away, but brokers who keep pretending they can mandate compliance through control will keep losing agents. The solution isn't to loosen standards. It's to build infrastructure so good that agents choose to use it.

Make onboarding asynchronous. Make knowledge instantly accessible. Make your systems better than the alternatives. Because agents don't leave because they want independence. They leave because you gave them overhead without support. Fix the infrastructure, and the retention problem fixes itself.